Web3 businesses are often founded by visionary technical experts skilled in blockchain development but lacking expertise in accounting and finance.

Web3 businesses are often founded by visionary technical experts skilled in blockchain development but lacking expertise in accounting and finance. Getting good financial habits and processes in place early on can help minimise problems that may otherwise spiral out of control.

The past few years have seen many Web3 innovations, from gaming and digital ownership with NFTs to decentralised finance (DeFi) platforms reimagining banking and lending. New business models like play to earn have emerged, involving high transaction volumes requiring new accounting methodologies.

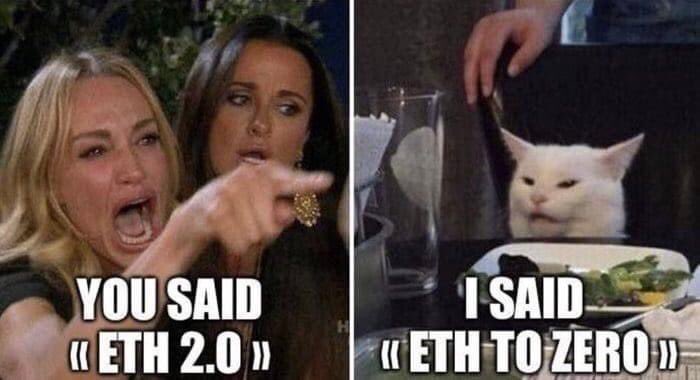

During the crypto bull market, accounting was rarely the focus as funding for early-stage blockchain projects was abundant, fuelled by stimulus money, low interest rates, and astronomical returns for early investors. Savvy marketing and fear of missing out (FOMO) further inflated a bubble filled with tokens, many of which will likely become worthless.

We are now in a crypto winter with very different economic circumstances than the last downturn. Most notably, the era of cheap money has ended as central banks have raised rates to control inflationary pressures. Implosions like Terra and Three Arrows Capital, as well as fraud cases like FTX, have highlighted the lack of controls and governance taken for granted in traditional financial markets. As blockchain transactions increase in complexity, the underlying infrastructure remains fragile.

Regulators have been vocal and are now catching up with the freewheeling crypto industry. The lucrative days of “going to the moon” appear to be in the past.

When markets are rising and profits are abundant, investors are forgiving, and the spotlight does not shine as brightly on accounting practices. We have seen this cycle before with Enron and the telecoms stocks of the early 2000s.

Web3 and blockchain-native businesses must now demonstrate more discipline around financial and reporting processes. They must prepare true and fair accounts that can withstand the scrutiny of audits to provide stakeholders with comfort and trust.

1) Valuation and Recognition Challenges

2) Transparency and Investor Confidence

3) Auditing Crypto

Accounting serves as a cornerstone of stability and trust in the dynamic world of cryptocurrencies and blockchain technology. By embracing sound financial management practices, companies can navigate the complexities of the crypto industry with confidence, fostering transparency, investor confidence, and long-term sustainability.

As the crypto landscape continues to evolve, the role of accounting will remain indispensable in shaping its future.